What Is the Blockchain Trilemma?

Imagine building a house where you want it to be strong, cheap, and built by everyone in your neighborhood. You can’t have all three. That’s the blockchain trilemma in a nutshell.

It’s the idea that no blockchain can be fully decentralized, secure, and scalable at the same time. You get two out of three - and you always have to give something up. This isn’t a bug. It’s a fundamental law of how blockchains work.

The term was coined by Vitalik Buterin back in 2017, and since then, every major blockchain has had to make a choice. Bitcoin chose security and decentralization. That’s why it’s so hard to hack and why anyone can run a node. But it processes only 7 transactions per second. Ethereum, after its upgrade, still sits at 15-30 TPS. Meanwhile, Visa handles 24,000.

So why does this matter? Because if your blockchain can’t handle real-world usage, it won’t be used. People won’t pay $50 in fees to send $50 worth of crypto. Developers won’t build apps that crash every time the network gets busy.

Decentralization: The Soul of Blockchain

Decentralization means no single company, government, or person controls the network. Instead, thousands of ordinary people run computers - called nodes - that verify transactions and keep the ledger honest.

Bitcoin has around 15,000 public nodes spread across the globe. Ethereum has over 8,500. That’s a lot of independent machines working together. The more nodes, the harder it is to attack or shut down the network. If one goes down, the rest keep going.

But here’s the catch: every time a new transaction happens, every node has to check it. That takes time. And more nodes = slower processing. That’s why Bitcoin and Ethereum can’t scale easily. To speed things up, you’d need fewer nodes. But then you lose decentralization.

Take Ripple (XRP). It processes 1,500 transactions per second - fast. But only 150 nodes validate transactions, and 110 of them are owned by Ripple Labs. That’s not decentralized. It’s more like a private database with a blockchain label.

Security: How Blockchains Stay Honest

Security is what keeps bad actors from stealing money or rewriting history. Blockchains use cryptography and consensus mechanisms to make tampering nearly impossible.

Bitcoin’s proof-of-work (PoW) system is the gold standard. Miners compete to solve complex math puzzles using massive amounts of electricity. The network spends about 110 terawatt-hours a year - more than some countries. That cost is intentional. It makes attacking Bitcoin prohibitively expensive.

Ethereum switched to proof-of-stake (PoS) in 2022. Instead of miners, validators lock up ETH as collateral. If they cheat, they lose their stake. It’s far more energy-efficient - using 99.95% less power than Bitcoin’s old system.

But PoS isn’t foolproof. If a small group controls most of the staked ETH, they could potentially manipulate the network. That’s why Ethereum has over 800,000 validators. The more participants, the harder it is to collude.

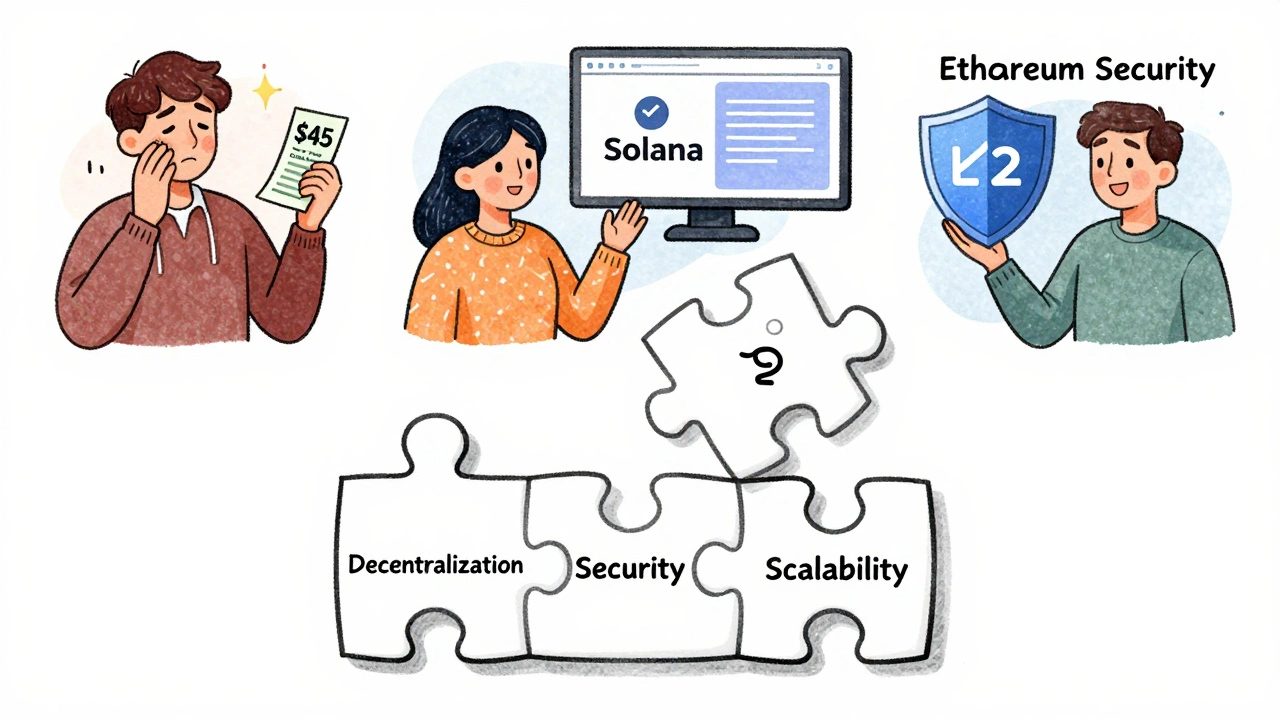

Compare that to Solana. It claims to be secure and fast, but it had six major outages in 2022. One lasted 19 hours. Why? Because its network relies on high-end hardware. Only 1,968 validators can run nodes. That’s not just fewer people - it’s fewer *types* of people. Only those with expensive gear can join. That weakens security over time.

Scalability: The Bottleneck Everyone Wants to Fix

Scalability is about speed and cost. Can the network handle thousands of transactions per second without fees spiking or delays dragging on?

Bitcoin’s 7 TPS means when demand rises - like during the 2017 crypto boom - fees jump to $55. Transactions take hours to confirm. People couldn’t use it for everyday payments. That’s not scalability.

Solana says it can do 65,000 TPS. In theory. In practice, it averages 2,000-3,000. Still impressive. But its network crashes when traffic spikes. Why? Because it’s optimized for speed, not resilience. It’s like a sports car that breaks down in the rain.

Cardano hits 250 TPS with 3,500 nodes. Polygon hits 7,000 TPS with only 100 validators. You see the pattern? To go faster, you reduce the number of people validating. That’s the trade-off.

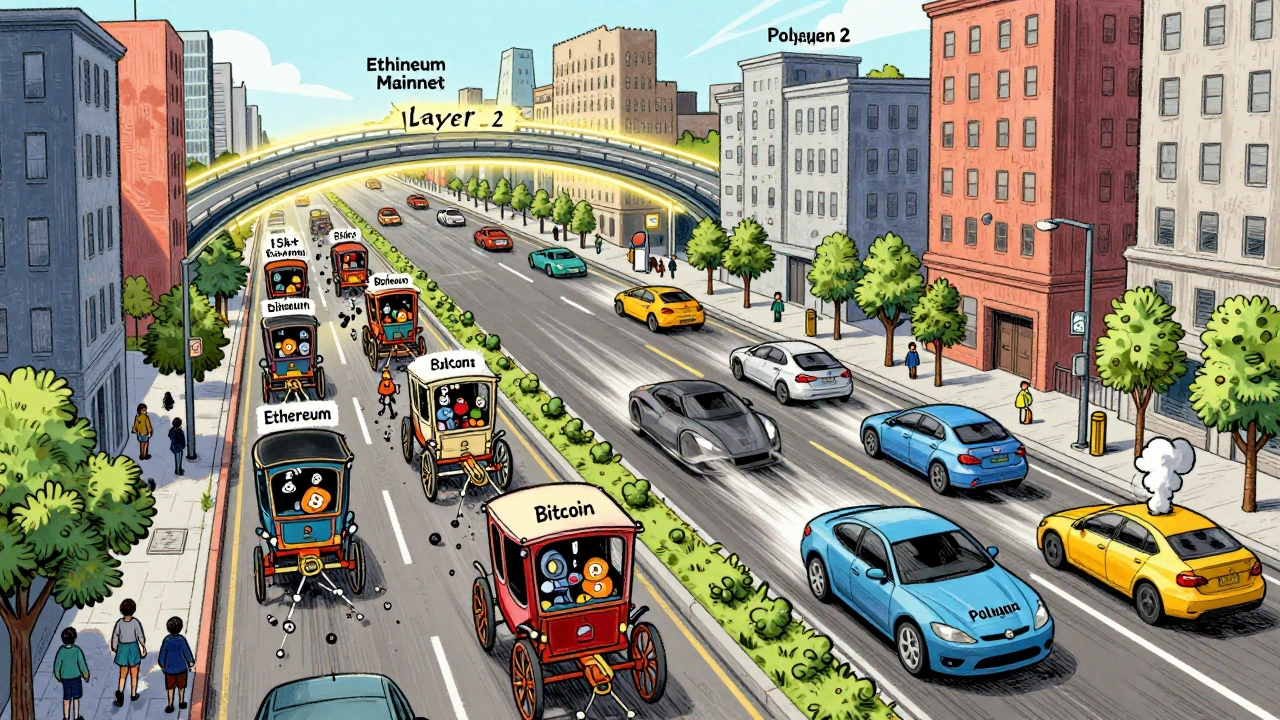

And here’s the kicker: most users don’t care about decentralization. They care about speed and low fees. That’s why Layer 2 solutions like Arbitrum and Optimism are booming. They run on top of Ethereum, handling thousands of transactions off-chain, then settle them securely on the main network. That’s how Ethereum maintains security and decentralization while scaling.

Real-World Trade-Offs: What Users Actually Experience

People aren’t debating theory. They’re paying fees, waiting for confirmations, or losing money when networks crash.

On Reddit, users complain about paying $45 in gas fees to swap $50 worth of tokens. That’s not finance - that’s a tax. On Solana forums, people celebrate fast NFT mints - until the network goes down for 8 hours and they lose their spot. One user lost $300 in opportunity.

Wallet reviews tell the same story. MetaMask gets 4.2 stars - loved for its Ethereum integration, hated for unpredictable fees. Phantom Wallet, built for Solana, scores 4.5 stars for speed, but 27% of negative reviews mention centralization fears.

Enterprise companies don’t even try to solve the trilemma. They use private blockchains like Hyperledger. No decentralization. No public nodes. Just fast, secure, permissioned ledgers. Why? Because they don’t need decentralization. They need compliance and speed.

How the Industry Is Trying to Break the Trilemma

Some developers think the trilemma is a myth. Solana’s founder says you can have all three. But his network’s outages prove otherwise. Engineering can push boundaries - but not break physics.

Here’s what’s actually working:

- Layer 2 solutions: Rollups like Arbitrum and Optimism bundle hundreds of transactions off-chain, then post one proof to Ethereum. They handle 5,000+ TPS with Ethereum’s security. This is the most successful approach so far.

- Sharding: Ethereum plans to split into 64 smaller chains (shards), each handling its own transactions. This could push throughput to 100,000 TPS. But it’s complex. Full implementation isn’t until 2026.

- Alternative consensus: Avalanche uses a novel protocol that reaches agreement faster. It handles 4,500 TPS with over 1,000 nodes - a better balance than Solana.

- Block size increases: Bitcoin Cash raised its block size to 32MB. Throughput jumped to 100 TPS. But node count dropped from 15,000 to 500. Decentralization took a hit.

The real winner? Layer 2. It lets Ethereum keep its soul - decentralization and security - while adding speed. That’s why over half of Ethereum’s transactions now happen on Layer 2.

What This Means for You

If you’re a user: choose based on what matters most. Need low fees and speed? Try Solana or Polygon. Want maximum security and decentralization? Stick with Ethereum and use a Layer 2 like Arbitrum.

If you’re a developer: understand the trade-offs before you build. Building on Solana means high performance but risk of downtime. Building on Ethereum means higher costs and complexity, but long-term stability.

If you’re an investor: don’t fall for hype. A blockchain that claims to solve the trilemma is either lying or hasn’t been tested under real stress. Look at uptime, node count, and fee history - not marketing slogans.

The trilemma isn’t going away. But we’re learning how to work around it. The future isn’t one blockchain that does everything. It’s a network of blockchains, each optimized for different needs - connected securely, efficiently, and fairly.

Final Thoughts: The Trilemma Is Real - But Not a Dead End

There’s no magic bullet. No blockchain will ever be as fast as Visa, as decentralized as Bitcoin, and as secure as a vault - all at once.

But we don’t need one. We need choices. Layer 2s give us speed without sacrificing Ethereum’s security. New Layer 1s like Berachain and Arbitrum Nova are experimenting with new balances. Even Bitcoin is slowly adding scaling tools like the Lightning Network, which can handle over a million transactions per second - off-chain.

The trilemma isn’t a flaw. It’s a guide. It tells us what to prioritize. And right now, the best path forward isn’t trying to break the rules. It’s working within them - smarter, layer by layer.