When a project decides to crypto burning is a mechanism that permanently removes a specified amount of tokens from the circulating supply by sending them to an address that no one can ever access, the move instantly reshapes market dynamics. Developers use burns to signal scarcity, reward holders, or correct an oversupply that threatens a token’s price stability. Below we break down the logic, the tech, the different burn models, real‑world case studies, and the risks you should watch out for.

Why Burn Tokens? The Economic Rationale

Token economics (often called "tokenomics") treat supply the same way traditional finance treats currency. If you shrink the denominator in the price‑per‑token equation, the numerator-usually demand-gets a larger share, driving price up. A Deflationary Token is a digital asset designed to decrease its total supply over time, typically through regular burns embodies this principle. Burns can also reset the incentive balance after a large airdrop, curb inflation caused by staking rewards, or simply generate publicity for a project.

How a Burn Actually Happens on‑chain

At the technical level, a burn is a transaction that moves tokens to a dead address - a public key with no known private key (e.g., 0x000…000). Because blockchain data is immutable, those coins become unrecoverable forever. The smart contract that governs the token usually contains a Burn Function a piece of code that reduces the totalSupply variable and emits a Burn event for tracking. When the function runs, the ledger updates two values: the sender’s balance drops, and the global totalSupply shrinks.

Burn Models: Manual, Automatic, and Buy‑back‑and‑Burn

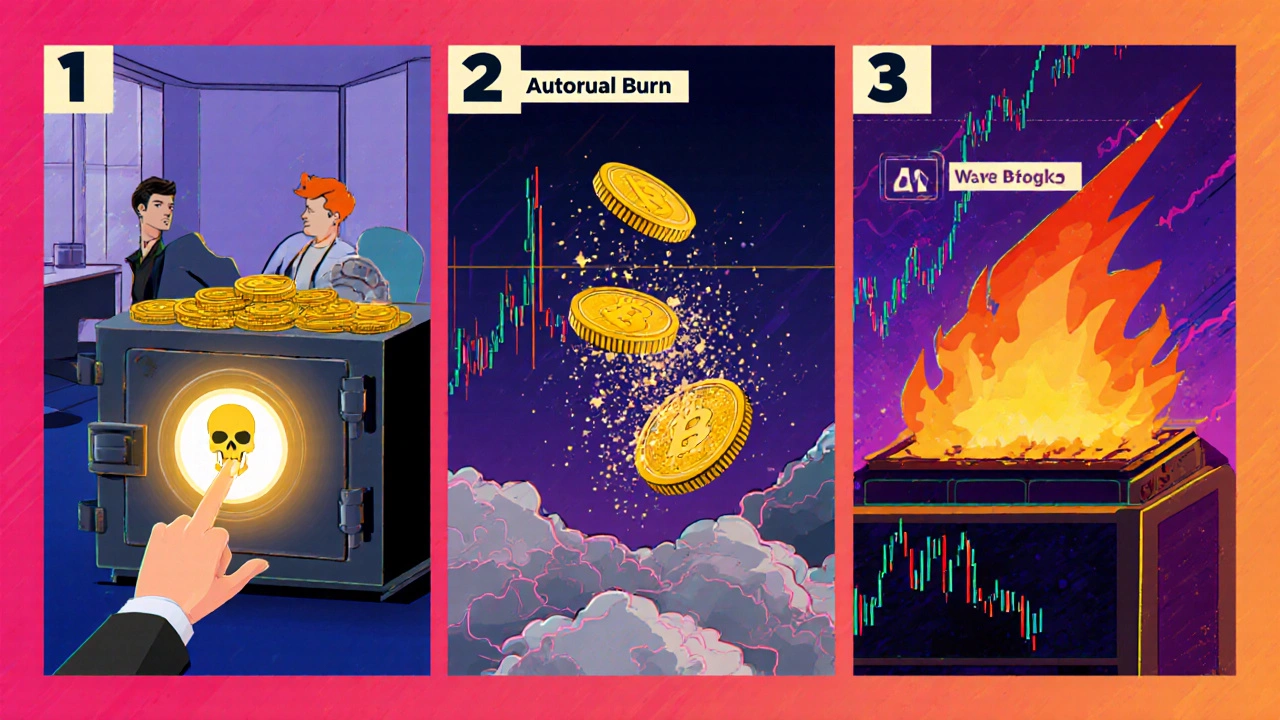

Not all burns are created equal. Projects choose a model that matches their governance style and community expectations.

| Model | Trigger | Control Layer | Typical Use‑Case |

|---|---|---|---|

| Manual Burn | Project team initiates a transaction | Governance‑controlled wallet | One‑off supply correction after an over‑mint |

| Automatic Burn | Every transfer or specific event fires the burn code | Embedded in token smart contract | Creating a continuously deflationary token (e.g., SafeMoon) |

| Buy‑back‑and‑Burn | Protocol buys tokens on the open market, then burns them | Treasury smart contract or DAO vote | Boosting price support while reducing supply (e.g., Binance’s BNB) |

Each approach has trade‑offs. Manual burns are transparent but rely on trust in the team. Automatic burns guarantee consistency but can add transaction‑fee overhead. Buy‑back‑and‑burn combines market demand with scarcity, yet it requires sufficient liquidity to execute purchases.

Key Platforms Supporting Burns

Most modern blockchains allow token contracts to include a burn function. The two ecosystems with the most public burn data are Ethereum the world’s leading smart‑contract platform, home to ERC‑20 tokens and Binance Smart Chain (BSC) a high‑throughput network that mirrors Ethereum’s tooling while offering lower fees. On Ethereum, the community tracks burns via the Burn event emitted by contracts like USDT, USDC, and many DeFi tokens. BSC’s explorer highlights the “Burn” tab for each BEP‑20 token, making it easy for investors to verify supply changes.

Case Studies: Real‑World Burns That Moved Markets

Case 1 - BNB Quarterly Burn - Binance commits to burning BNB each quarter until 100million tokens remain. The protocol calculates the amount based on the amount of Binance Coin held on its exchange, then sends the tokens to a dead address. Since the program started in 2019, BNB’s circulating supply has dropped by over 30%, and the token’s price has risen roughly 12% on average after each burn announcement.

Case 2 - Polygon’s $100M Token Buy‑back‑and‑Burn - In 2023, Polygon’s treasury allocated $100million of USDC to purchase MATIC on the open market. The purchased tokens were immediately burned, cutting total supply by 5%. The market reacted with a 7% price uptick in the following 24hours, illustrating how combining buying pressure with scarcity can ignite momentum.

Case 3 - Solana’s Manual Burn of New Token Launches - Several Solana projects have minted large token supplies for airdrop and later burned up to 40% of the initial issuance to restore balance. Because Solana’s transaction costs are sub‑cent, these manual burns are cheap and fast, allowing rapid supply adjustments during early‑stage community growth.

Risks and Common Pitfalls

Even though a burn sounds like a free‑upgrade, it carries hidden dangers. First, the market may view a burn as a gimmick if it isn’t backed by genuine demand, leading to a short‑term price spike that quickly fades. Second, automatic burns that deduct a portion of every transfer can discourage users from moving tokens, reducing network activity and potentially lowering liquidity. Third, if a project burns too much, the remaining supply may become too scarce, driving price volatility that harms everyday users.

Technical mistakes also happen. A poorly written smart contract might direct tokens to an address that’s not truly dead (e.g., a contract that can later withdraw). Auditors recommend using the universally recognized dead address 0x000000000000000000000000000000000000dEaD on Ethereum‑compatible chains to avoid accidental reversibility.

How to Verify a Burn Yourself

Investors can perform a quick on‑chain check:

- Open the blockchain explorer for the token’s network (Etherscan for Ethereum, BSCScan for BSC, Solscan for Solana).

- Search the token contract address.

- Navigate to the “Token Tracker” page and look for a “Burn” or “Supply” tab.

- Cross‑reference the

totalSupplyfield before and after the burn transaction hash displayed in the event logs. - Confirm that the destination address is a dead address; if it’s a regular wallet, the tokens could be moved later.

For added confidence, many projects publish a burn receipt in a community post, linking the transaction hash and the amount destroyed. This practice builds trust and satisfies regulators who are increasingly scrutinizing supply‑manipulation tactics.

Future Trends: Automated Deflation in 2025 and Beyond

As DeFi matures, we are seeing a shift toward “self‑adjusting” tokenomics. Protocols integrate on‑chain price oracles to trigger burns when the token price falls below a certain threshold, effectively providing a built‑in price floor. Meanwhile, Layer‑2 solutions like Arbitrum and Optimism are experimenting with “gas‑less” burns that cost users nothing because the fee is subsidized by the protocol’s treasury.

Another emerging concept is cross‑chain burn‑mint bridges. When a token migrates from one chain to another, the original tokens are burned on the source chain, and new tokens are minted on the destination. This method preserves total supply while enabling ecosystem expansion-a technique used by the Wormhole bridge for SOL and USDC.

Quick Checklist Before You Trust a Burn

- Is the burn address officially verified as a dead address?

- Does the project publish the transaction hash and an immutable receipt?

- Is the burn model aligned with the token’s stated economic goals?

- Are there independent audits confirming the burn function works as intended?

- Do you understand the potential impact on liquidity and volatility?

Frequently Asked Questions

What does a token burn actually do to my holdings?

A burn reduces the total number of tokens in circulation. If demand stays the same, each remaining token represents a slightly larger share of the market, which can lift the price. Your personal balance doesn’t change unless you own tokens that are sent to the dead address.

Can a burn be reversed?

No. Once tokens are sent to a truly dead address (one with no private key), they are irretrievable. If a project mistakenly burns to a regular wallet, the tokens could be moved later, which is why audits stress using the standard dead address.

How often do major projects perform burns?

Frequency varies. Binance burns BNB quarterly, Polygon does quarterly buy‑backs, while some DeFi tokens burn a small percentage on every transaction. The schedule is usually outlined in the token’s whitepaper or governance proposals.

Do burns affect transaction fees?

Automatic burns that trigger on each transfer add a tiny amount of extra gas because the contract must execute the burn logic. Manual or buy‑back‑and‑burn actions are separate transactions, so they only cost the fee for that single operation.

Is a burn a reliable way to increase token price?

A burn creates scarcity, which can support price growth, but it’s not a guarantee. Market sentiment, utility, and overall demand still drive price. Burns work best when paired with strong use‑cases and active community participation.